This is the Final Part. Find Part I here and Part V here.

Author’s note (Winter 2021): my desire to avoid advocacy occasionally trumps my desire to write with maximum clarity. I apologize. But I do write under my own name, and I have no desire to get pulled into some tangential culture-war argument between under-read mooks. To that end, if there is wisdom and insight in this essay series, it is mostly contained in the prior sections. If you’d like a more earnest discussion about the future, you’ll have to sit down with me in person over a cup of tea :)

Yeah, of course you can. Look outside. Look in any history book. Watch any Disney movie. Nobody ever doubted you could — the argument has always been about how (and who).

I’ve presented 5 frameworks, “Stacks of Society”, that I’ve come to rely on in describing, analyzing, evaluating, and advocating for different methods of Wealth-building. It’s just a Narrative, a loosely-linked story that I put together, not a gospel, not perfect, not even close to complete. There’s 10,000 words of examples and counter-examples that I’ve cut out and dumped into a document called “Draft”, never to see the light of day. I’m sure a number of the people I linked to will be irritated to be included in an Essay surrounded by links and quotes to their deep ideological opponents. No hard feelings, please, I’m just trying to understand the shape of things.

I linked to his most interesting Report in my Industrialism section, but it’s worth quoting Alexander Hamilton explicitly for his willingness to advocate for one specific thing (increased Government Debt), and then to acknowledge within that exact same advocacy that the reality was likely mixed, that the maximal public good is rarely found in extremes, that there would be a “perpetual tendency” to raise ever-more Debt, and that such a tendency should be fought “unceasingly” (lol, yeah, about that…).

Say what you will about his ideas, good or bad, but don’t say he didn’t understand his intellectual opponents’ concerns on a deep level. Something something dialectic & synthesis.

Remarks of this kind are not made in the spirit of complaint. ’Tis for the nations whose regulations are alluded to to judge for themselves whether, by aiming at too much, they do not lose more than they gain. ’Tis for the United States to consider by what means they can render themselves least dependent on the combinations, right or wrong, of foreign policy.

Translation: “I’m just trying to find the sweet spot, right or wrong, where we can all get rich regardless of how Europe tries to screw us.”

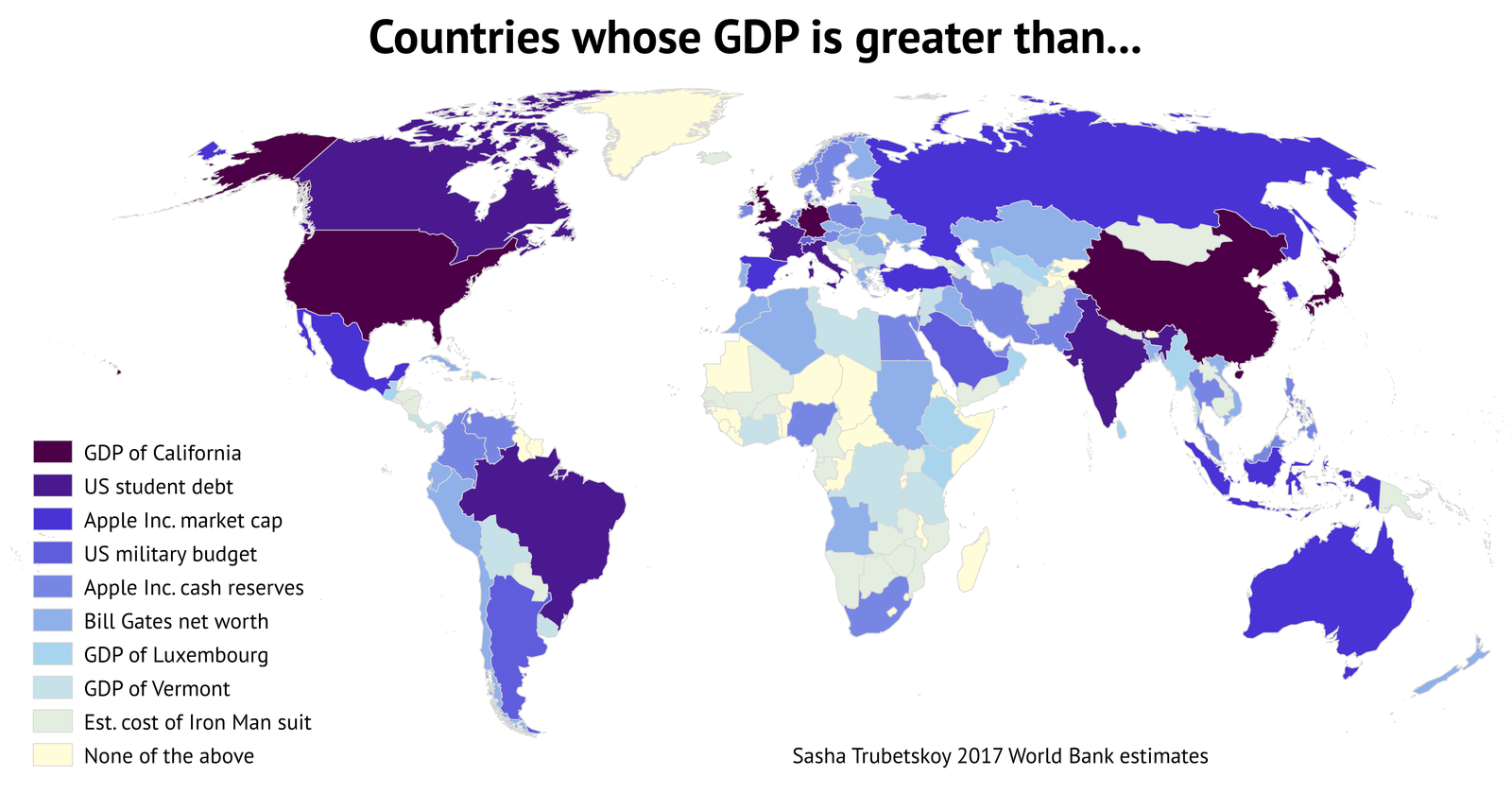

While every layer of the Stack can operate at the same time in the same place, not all nations are equipped to run the Full Stack. Singapore is not Qatar is not Ireland is not the United States is not Switzerland is not Germany. But they’re all in the top 20 for GDP-per-capita, and the leaders & citizens of each must choose different strategies to build Wealth. Success in each layer has preconditions, both “natural” (resources, ports, climate, etc.) and “human” (policy, culture, capital, etc.).

What’s more, there’s a tension between the layers that I tried to highlight by structuring them into a Stack:

If you want to run Industrialism to the fullest, you need to be careful of Feudal policies hindering your growth by “Taking and Taxing” Capital away from Industrial reinvestment. (See: China & South Korea opening “Special Economic Zones” isolated from their standard domestic policies)

If you want to run Globalism, you have to be “the bigger man” and avoid playing Zero-Sum Mercantilist value-Capture games with your Trade partners, while also finding some combination of [Carrots] and [Sticks] that can keep everyone else from taking advantage of your benevolence. It is not enough to just be “bigger” — the [Carrots] and [Sticks] are critical to success. (See: Bretton Woods' global currency pegs, coupled with US foreign investment & trade [Carrots] and control of oil & naval trade routes [Sticks] limiting the surface area of possible game-playing)

If you want to run Financialism, bear in mind that you need much fewer people to efficiently direct Capital flows than you do to actually build & sell things (hardware or software) so unless you transition to Financialism directly from Feudalism you’re going to have a lot of people who suddenly don’t “touch” the Wealth-building process anymore (not involved in the process == zero opportunities to Capture Wealth), but who once did and remember how nice that felt. Political and Cultural implications of this abound.

I said in my intro that when it comes to Wealth, analysis and advocacy are inseparable. I’ve done a lot of bloviating tea-and-chocolate-fueled analysis here. Have I done any advocacy? Probably - I can't escape my biases. I didn't have some of the biases before I started this essay/project, but the act of learning shapes my worldview, pushes me towards certain solutions, influences which words I use to tell my Narrative. But to spell those biases out clearly:

I’ve come to believe that Financialism, as it exists today in America — and to varying degrees in Japan, Great Britain, France, China, and Germany — is the most powerful function for accelerating Wealth-building and compounding success. Wherever the Capital is directed by those financial centers will experience the benefits of Compounding Wealth. Whoever is able to direct the Capital, and directly profit from the returns to doing so, will likewise experience the benefits of Compounding Wealth.

Left alone, those Nations/Cities/Companies/People most successful at Compounding Wealth will end up being the "Whoever”, and they’ll direct the Capital to “Wherever” the risk-adjusted-returns are calculated to be highest. Self-interest takes care of that.

Exerting Political will to influence the Wherever and the Whoever is possible, and a hazy calculus on the benefits of each can be done. Most times such calculus will return a negative total value, and whenever it looks positive, a reasonable suspicion is warranted. Quintuple check the numbers yourself and be wary of everyone who stands to gain (which is everyone).

Feudalism attempts to influence the Whoever, to change who benefits via taxation and redistribution.

Mercantilism reinforces the relative Wealth & Power of Ownership, shifting both Wherever and Whoever to those who can maintain possession of scarce resources.

Industrialism and Globalism both attempt to influence the Wherever, to shift the flows of Capital such that they directly benefit some portion of the domestic population.

Financialism can be coupled with any combination of those strategies — or none at all — and accelerates whatever you choose.

Choose wisely.

Notes

[0] For each of the commenters, if we take their only goal as Wealth-building, then my interpretation of each position is:

Government regulated healthcare is preferable to paying $108,951 for a surprise one-time trip to the hospital despite being a healthy Ironman triathlete with no pre-existing conditions

Fewer government regulations is preferable to your small business spending $10,585 per employee to conform with expensive red tape (economies of scale work on regulations too)

Limited immigration is preferable to competing for a job with immigrants willing to work harder and longer than the average American? (Wow there’s a lot of Google hits for “immigrants work harder”. Also, “hi!” from an immigrant!)

Maybe these commenters would disagree with my reading of their comments, but I think this is reasonable & charitable, and I can’t imagine the three of them reaching an agreement.

[1] As long as there are many possible products to produce profitably, the Industrialist-factory-owners are forced into competition with each other for labor. This competition creates, for perhaps the first time, a manufactured “scarcity” of domestic laborers — anyone willing to pay higher wages can shift labor allocation to his own factories. Unsurprisingly, this market power turns out to be pretty good for domestic labor, but it’s worth remembering that it’s only the competition among Industrialists with profitable factories that distinguishes the factory-laborer from the Feudal peasant. Demand for domestic labor can be capricious, moving at the whims of politics, economics, technology, and even culture.

[2] Expanding on my reading of history & the “Industrialism playbook”:

China copied and improved South Korean Industrialism (1980)

In 1962, South Korean ruler Park Chung-hee launched the coastal port of Ulsan as a “special industrial development zone” and enacted a set of export-focused policies, attractive to foreign investment, with a currency pegged to the US dollar

Gee that sounds familiar…(Right-click on page, Translate to English, then sacrifice a goat to Google)

The tight link between economics and politics was nurtured in Korea through well-connected family-owned vertical monopolies (Chaebol)

South Korea copied and improved Japanese Industrialism (1960)

Park Chung-hee grew up under Japanese rule, quit his teaching job to enlist in the Imperial Japanese Army, and was a big fan of how rapidly Meiji Japan industrialized to compete with the West

South Korea’s “Chaebol” were intentionally carbon-copies of Meiji Japanese Zaibatsu — both words are even written the same way — vertically-integrated family-owned politically-connected monopolies

From 1949 to 1971, the Japanese Yen was pegged to the US Dollar, which I’m told led to “Japanese exports costing too little in international markets” — hardly a problem for Japan!

Commodore Perry pried open Japan and forcibly created five cities as special economic zones from the very beginning of Japan’s industrialization

Taxes were then funneled via the Bank of Japan into the creation of domestic productive industrial capacity with a strong move away from imports (‘kokusanka’)

Commodore Perry would have wept to realize he was playing a Mercantilist game in a new Industrialist world

Japan copied and improved German Industrialism (1870)

Japan’s First Prime Minister, Ito Hirobumi, was one of the first five Japanese to study in England, providing a glimpse of what Industrialism had already done for Europe — obvious parallels to Deng Xiaoping’s childhood experience

Twenty years after his trip to England, he led another study mission to Europe, spending most of his time in Germany — or, as it was known then, The German Empire

The German Empire at this point had already rapidly industrialized and overtaken Britain as the largest economy in Europe — and, importantly, as the largest exporter of manufactured goods

They didn’t have Chaebols or Zaibatsu — they had “Konzerne” — politically-connected vertical monopolies formed around family businesses, which optimistically translates to “concern” and realistically translates to “cartel”. Regardless of translation, the function was the same

Wikipedia spells it out: “being significantly concentrated, [Konzerne were] able to make more efficient use of capital”

Capitalism is about accumulating capital — I quoted German-born Peter Thiel much earlier: “Competition is for losers” — you can’t invest if you don’t have capital, and you can’t build capital if profits are competed away

The German Empire used “investments on the part of the state in new sectors where the technology required large infrastructure (and quantities of money) before becoming profitable…German workers were given arguably the best benefits in all of Europe in exchange for accepting the most severe discipline and higher productivity…”

The intentional parallels between Japanese and German workplace culture should not be missed — as well as the eventual cultural parallels outside the workplace (fascism)

And they believed: “It must be added that it was undoubtedly only in this way that the incipient German industry could resist the competition from British product, which invaded the continent…and would have hacked any of the first German factories into pieces.” (Credit to Gilles Campagnolo)

Germany copied and improved British Industrialism (1850)

The Industrial Revolution began in Britain and after the dismantling of the Indian textile industry, Mercantilist Britain was no stranger to putting its own national private interests first

For 100 years, the British East India Company held a private monopoly on all global trade outside of Europe, granted by Queen Elizabeth, renewed by Parliament, enforced by the Royal Navy

The English didn’t have Chaebols, Zaibatsu, or Konzernes — they had “Joint Stock Companies”, an entity that could only be created with explicit permission from Parliament and one that should be familiar to every reader today

As one German economist from the 1800s observed: “Any nation which by means of protective duties and restrictions on navigation has raised her manufacturing power and her navigation to such a degree of development that no other nation can sustain free competition with her, can do nothing wiser than to throw away these ladders of her greatness, to preach to other nations the benefits of free trade, and to declare in penitent tones that she has hitherto wandered in the paths of error, and has now for the first time succeeded in discovering the truth”